INTRODUCTION

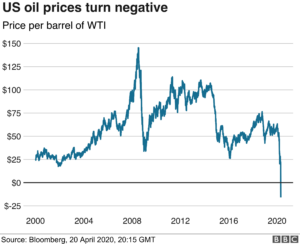

Oil is one of the most valued commodities of the world, their dominance has been overturned by this pandemic’s lockdown. The worth of Oil barrel of the United States fell to nothing and for the first time in history has turned negative. The demand for oil diminished due to coronavirus lockdown in the world as it has kept people in their houses. This resulted in oil firms renting tankers to stockpile a surplus supply of the oil in the market, whose consequence is the adverse price of oil in the United States. The price of a barrel of West Texas Intermediate[1] (WTI), the benchmark for US oil, fell as low as minus $37.63 a barrel and the crude oil producers were willing to pay someone to take the product off their hands. This distress of where to keep the oil has led to a severe drop for WTI. Oil is generally traded on futures contracts and prices for crude to be delivered in June are now at its all-time low at $20. The international benchmark for Brent crude oil also went to its lowest in 18 years- down 8.9% at less than $26 a barrel.

“This is off-the-charts wacky,” said Stewart Glickman, an energy equity analyst at CFRA Research.[2] “The demand shock was so massive that it had overwhelmed anything that people could have expected.”

OGUK, the business lobby for the UK’s offshore oil and gas sector stated that the negative price of US oil would hamper the firms operating in the North Sea. There is a tug of war going between both tumbling demand and infighting among producers about reducing output. Initially, this month OPEC and its allies agreed upon an agreement to slash the output by about 10%. Thus, resulting in the deal which has caused the most massive cut in oil production ever made.

According to the belief of many analysts, the cuts were not too big to make a difference.

“It has not taken long for the market to recognize that the Opec+ deal will not, in its present form, be enough to balance oil markets,” said Stephen Innes, chief global market strategist at AxiCorp

WHAT NEGATIVE OIL PRICES MEAN AND HOW THE IMPACT COULD LAST?

The inexplicable thing that happened in the market does not mean one can make money storing the oil, or that gasoline will cost nothing. The price of crude oil is accounted for only about a third of the price of gasoline and diesel at the pump. Refining, distribution cost, and taxes account for much of the price, and why negative oil prices will not mean free gasoline.

The negative price concerns only the contracts for the delivery of barrels in May that are traded on the so-called futures markets. As a result, traders, this week are trying to get rid of the product rather than figuring out how to store it. The May contracts that fell so much ended on 21st Apr’ 2020 and the price of June contract is still in positive territory, though even their prices have fallen in recent weeks.

WILL THE PRICE OF OIL STAY OR BECOME NEGATIVE AGAIN?

Experts do not suppose that the prices of the oil will remain negative for weeks and months. Demand for oil is likely to be tepid for months because few connoisseurs believe that the economy will quickly rebound to where it was before the pandemic[3].

This problem of negative oil prices will put pressure on countries like Saudi Arabia and Russia, huge producers to pump less oil because they will run out of room to store it.[4]

This will further help in lifting prices or by slowing down the declines.

Observing Monday’s abnormal fall in crisis was an aide-mémoire that the world economy has changed a lot since the last oil crisis.

BIBLIOGRAPHY

- https://www.bbc.com/news/business-52350082

- https://www.bloomberg.com/news/articles/2020-03-19/the-idea-of-negative-oil-prices-is-more-realistic-than-you-think

- https://www.aljazeera.com/programmes/insidestory/2020/04/oil-prices-hit-negative-territory-200421190204281.html

[1] Ward, Sandra. “Commodities On The Rebound.” Global Finance, vol. 31, no. 4, Global Finance Media Inc., Apr. 2017, p. 10.

[2] “US Oil Prices Drop to 21-Year Low as Demand dries up.” BBC News, BBC, 20 Apr. 2020, www.bbc.com/news/business-52350082.

[3] Bajaj, Vikas. “What Negative Oil Prices Mean and How the Impact Could Last.” The New York Times, The New York Times, 21 Apr. 2020, www.nytimes.com/article/negative-oil-prices-facts-history.html.

[4] Ibid

Best you can see in the morning !